Termites can do dangerous damage to your home if gone unnoticed. If you are on the verge of selling your house and you notice the lurking issues of termites beneath the surfaces, you’ll have to start acting fast. You must have questions like; is it possible to sell my house fast with termite damage? Who will buy my house with termite damage? Can you sell With Termites Damage? The answer is yes.

Selling your home with termite damage is possible with multiple modes and means.

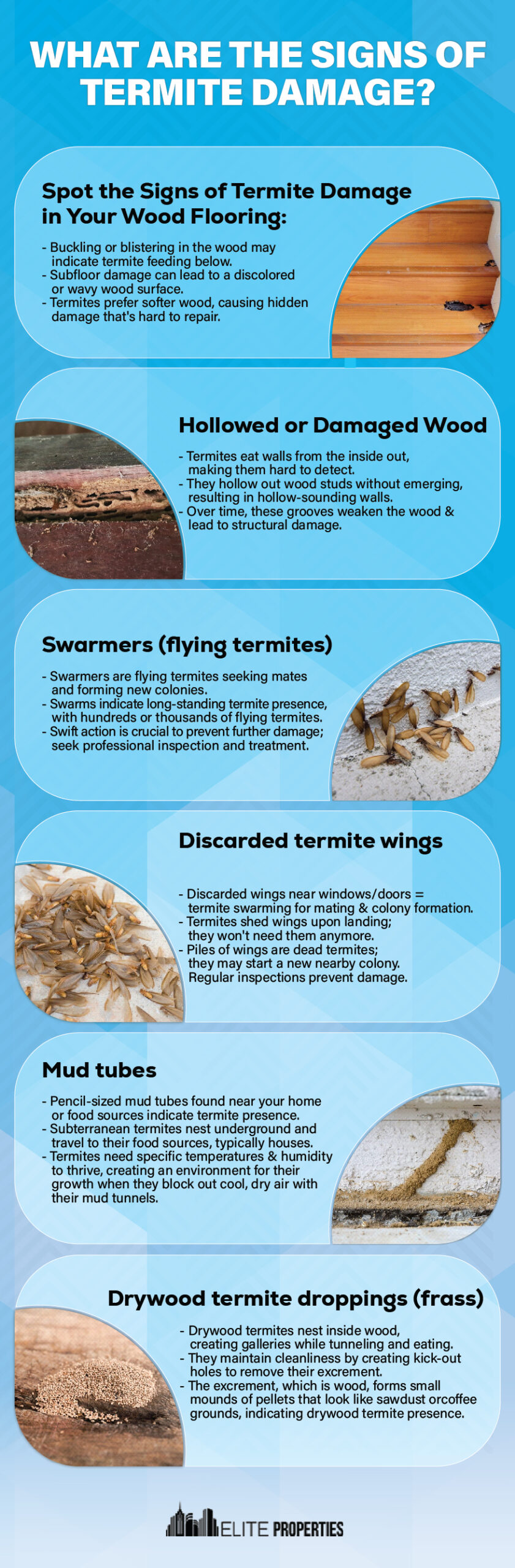

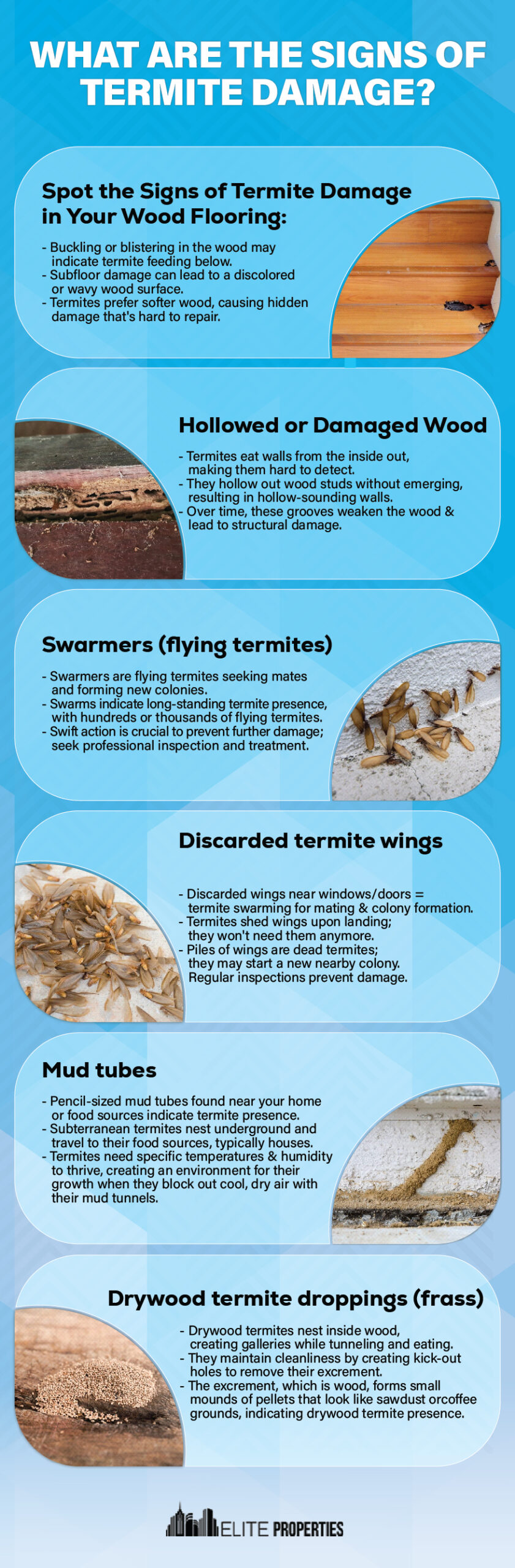

Signs of termite infestation

Termites are notorious for their ability to remain hidden until significant damage has been done. By knowing the signs of termite infestation, you can catch the problem early and prevent further destruction.

One of the most common signs is the presence of mud tubes, which termites create as tunnels to travel between their nest and food sources. These tubes are usually found along the foundation of your house or on walls.

Another indication of termite activity is the presence of discarded wings near windowsills or door frames. Termites shed their wings after swarming, so finding these wings is a clear sign that termites are nearby.

Additionally, if you notice small holes in wooden structures or furniture, it could indicate termite damage. These holes are created by worker termites as they tunnel through the wood to access their food source. Being vigilant and recognizing these signs can save you from costly repairs down the line.

Types of termites

Before we dive deeper into termite damage, it’s important to understand the different types of termites that may be infesting your home.

The three main types. They are

- Subterranean termites

- Drywood termites

- Dampwood termites

Subterranean termites: Subterranean termites are the most common and cause the most damage. They build their nests in the soil but can access above-ground structures through mud tubes.

Drywood termites: Drywood termites, on the other hand, infest dry wood and do not require contact with the soil. They can be found in furniture, wooden beams, or other wooden objects.

Dampwood termites: Lastly, dampwood termites thrive in damp and decaying wood, such as logs or tree stumps. Understanding the behavior and preferences of each termite species will help you identify the extent of the infestation and choose the most appropriate treatment.

The dangers of termite damage

Termite damage can be devastating, compromising the structural integrity of your house and leading to costly repairs. Termites feed on cellulose, which is found in wood and other plant materials. As they tunnel through wooden structures, they weaken them, causing sagging floors, buckling walls, and even collapsing ceilings. This not only poses a safety hazard but also lowers the value of your property.

Furthermore, termites can also damage electrical wiring, putting your home at risk of fire. It’s crucial to address termite infestations promptly to minimize the potential dangers and protect your investment.

How to inspect your home for termites?

- Regular inspections are essential for detecting termite infestations early.

- Start by examining the exterior of your house, paying close attention to the foundation, walls, and wooden structures.

- Look for mud tubes, discarded wings, or any signs of damage.

- Inspect your attic, basement, and crawl spaces, as termites tend to thrive in dark and humid areas.

- Check for hollow-sounding wood or any cracks and crevices where termites might be hiding. You can also use a flashlight and a screwdriver to tap on wooden surfaces to determine if they are hollow or damaged.

- Remember to inspect both the interior and exterior of your home, including wooden furniture and fixtures.

- By conducting regular inspections, you can catch termite infestations early and take appropriate action.

How to identify termite damage your house?

Termite damage can manifest in various ways, depending on the location within your house. In the kitchen, for example, termites may target wooden cabinets, countertops, or flooring. Look for blistering or peeling paint, warped wooden surfaces, or small holes in the wood.

In the bathroom, termites can damage wooden fixtures, such as cabinets or vanities. Check for any signs of water damage or wood that appears swollen or discolored.

In the living room, termites may go after wooden furniture or moldings. Inspect these items for signs of termite activity, such as small holes or wood that sounds hollow when tapped.

Remember to inspect other areas of your house, such as bedrooms, dining rooms, or basements, as termites can infest any part of your home where wood is present.

Identifying termite damage in different areas allows you to target your repair efforts effectively.

Steps to repair termite damage

Once you have identified termite damage, it’s important to take immediate action to repair and restore the affected areas. Depending on the extent of the damage, you may need to replace or reinforce damaged wooden structures.

- Start by removing any infested wood and replacing it with new, termite-resistant materials.

- Reinforce weakened structures by adding support beams or braces.

- If the damage is extensive, it may be necessary to consult a professional contractor or carpenter to ensure proper repairs.

- Additionally, consider treating the surrounding areas with termite control products to prevent further infestations.

- Remember to seal any cracks or crevices where termites may gain access to your home.

By following these steps, you can restore the integrity of your house and prevent future termite damage.

Steps to Sell Your House with Termite Damage

1. Find Out About The Damage

If you suspect that there’s termite damage on your home, call an expert who will inspect the area and provide you with a free estimate.

2. Pest Inspection Is a Must

Paying for a pest inspection is a must when you spot specks of termite infestation in nooks and corners. While listing your home in the market you wouldn’t want people to notice the ugly eaten particles of wood on your stairs, doors, or cabinets. You’d want to call for an expert who deals with such intricate situations more often. Calling an expert will cut down the hassles of handling termites. But it will cost you a lot of money that you wouldn’t want to spend while listing your home.

3. Fix The Damage

Once you’ve determined that there is termite damage on your house, you need to fix it before you sell. This means removing any damaged wood and replacing it with new material.

It turns out to be important to deal with the damages and repair them. You should do this prior to listing your home on the market. Termites have a defined way of damaging things, you have to act fast when you see signs like discarded wooden droppings on the way. There are many signs from which you can distinguish there are termites residing in your house.

4. Signs of Termite Infestation

- Blistering or dark spots on wooden flooring

- Hollow wood

- Wings

- Tubing

- Droppings

5. Offer a Warranty to Potential Buyers

To make potential buyers feel good about buying a termite-infested house is to offer them a warranty period, post the pest infection. Usually, a termite repair treatment offers a year guarantee period. You can later transfer to the potential buyers at the time of purchase. The warranty defines a history of termites in your house which helps with the sales, it also defines that the property has been well maintained.

6. Negotiate Price And Terms

If you’ve been thinking about selling your home, now is the perfect time to start looking for buyers. However, before you begin negotiating with potential buyers, make sure you understand what you need to do to sell your home. This includes getting rid of any issues that might prevent a buyer from buying your home.

7. Reveal the Known Issues

As bad as it sounds it can help you in a lucrative sale. When you list your home under the tag of ‘termite damage’ for obvious reasons it won’t be the first pick between buyers. Although, if you find potential buyers on your side you’ll have to be proactive and keep things crystal clear. Informing buyers about the termite damage and how you tackled it could be beneficial for you and the buyer as well. It will assure the buyers that the home was been taken care of and maintained throughout. Also, provide them with all the documents that prove adequate care was taken on time from the right people. Before proceeding with the sale, take in writing that the buyer agrees to buy the house in as-is condition to avoid chaos later.

8. Keep an Open Mind for Offers

As you sell your house with termite damage with optimum repair, it becomes important for you to be open to lowball offers or you can cut down the price by a large chunk. Keep an open mind for negotiating offers for a lesser profit, as there are many reasons for a buyer to not buy your house in the first place.

9. Sell Your House As-Is

If your home is tagged under the label of termite damage, it becomes impossible to sell it even after you’ve cured all the impairment. Opting for the traditional way of selling your home might never provide enough yield for the sale. Because it is risky for buyers to invest in an as-is house. In such a scenario, the best way is to sell your house as-is for cash to ‘we buy houses’ companies.

You can avoid this Termite damage by going through this guide.

How to Prevent termite infestations in future?

- Prevention is key when it comes to termite control.

- To minimize the risk of future infestations, start by eliminating any sources of excess moisture around your house.

- Repair leaky pipes, ensure proper drainage, and redirect water away from the foundation.

- Remove any wood debris, such as fallen trees or stumps, from your yard, as they can attract termites.

- Use termite-resistant materials when building or renovating your home, such as treated wood or concrete.

- Consider installing physical barriers, such as metal screens or mesh, to prevent termites from accessing your house.

- Regularly inspect your home and monitor for any signs of termite activity.

By taking preventive measures, you can significantly reduce the likelihood of termite infestations and protect your home for years to come.

Bottom Line

To sell your house with termite damage, you’d want to convince buyers and do a lot of unwanted things while you are short of time. Moreover, you can consider selling your house as-is to ‘cash buying companies. Elite Properties can be your ideal choice when you want to sell your house fast with termite damage in New York. Selling your house to us will assure you an all-cash offer with no obligations. You can contact us at Elite Properties or call us at 718-977-5462 and rest assured we will buy your house in as-is condition. Furthermore, if you have any queries regarding real estate we will be happy to help and give the best possible solutions to all your problems.