As you are near retirement, it’s a good time to start thinking about downsizing your home. The idea of moving into a smaller space can be daunting, but the benefits are huge.

Downsizing can have a significant impact on savings and financial planning for retirement. By selling a larger home, you can free up funds that can be used to boost your retirement savings. It can also mean less maintenance and fewer responsibilities for you to worry about in retirement.

In this guide, let’s try to take a closer look at downsizing so that you can enjoy a stress-free transition into your new home for retirement.

We’ll also provide tips on how to start the process of decluttering and organizing your current home, as well as how to sell your house and move to a smaller property. So, let’s dive in!

Understanding The Concept Of ‘Downsizing’

Moving to a smaller home for retirement is what downsizing entails. It offers the advantages of reduced maintenance and lower expenses due to the smaller space.

People often consider downsizing when they retire, as it can be a strategic financial decision, allowing individuals to save money and allocate resources efficiently.

By embracing a smaller home, you can optimize their living situation and create a more manageable space. This transition offers the opportunity to let go of unnecessary belongings and focus on a simpler and more fulfilling lifestyle.

Benefits of downsizing your home

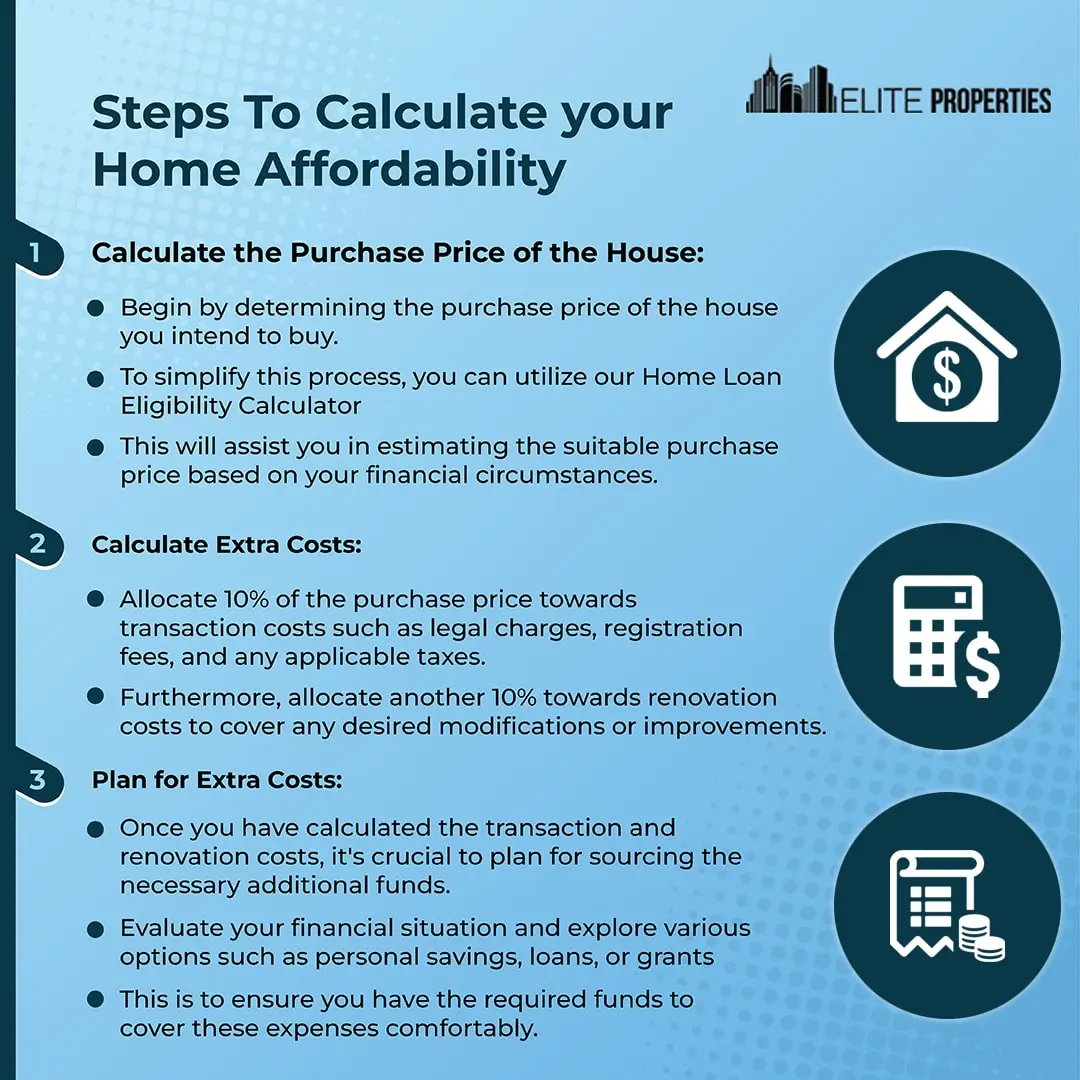

Downsizing refers to the process of moving from a larger home to a smaller one, typically to simplify and streamline your lifestyle. The benefits of downsizing can be numerous.

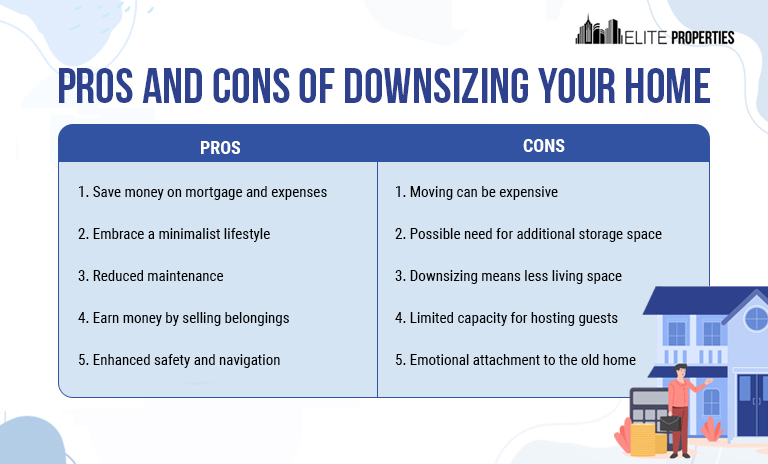

- It can free up a significant amount of money by reducing mortgage payments, property taxes, and utility bills.

- Downsizing can lead to a more manageable and easier-to-maintain living space, allowing for more time and freedom to pursue other activities.

- Downsizing can encourage a more minimalist lifestyle, helping to declutter and simplify your belongings.

However, downsizing is not without its challenges. Letting go of sentimental items and adjusting to a smaller living space can be emotionally and mentally taxing. Furthermore, it requires careful planning and consideration to ensure that the new home meets your needs and accommodates your lifestyle.

Challenges of downsizing your home

- Financial freedom and reduced expenses

One of the most significant benefits of downsizing your home is the potential for financial freedom. By moving to a smaller property, you can significantly reduce your mortgage payments, property taxes, and utility bills. This can free up a substantial amount of money that can be used for other purposes, such as saving for retirement, traveling, or pursuing hobbies and interests. Additionally, downsizing can help you eliminate unnecessary expenses associated with maintaining a larger home, such as higher insurance costs and expensive repairs.

- Simplified and easier-to-maintain living space

Living in a smaller home can make life much simpler and more manageable. With less square footage to clean and maintain, you’ll have more time and energy to focus on the things that matter most to you. Downsizing can also make it easier to stay organized and clutter-free, as you’ll have less space to accumulate unnecessary belongings. This can lead to a more peaceful and stress-free living environment.

- Embracing a minimalist lifestyle

Downsizing your home often goes hand in hand with embracing a minimalist lifestyle. When you have less space, you naturally become more mindful of the items you bring into your home. This can lead to a greater sense of clarity and focus, as well as a reduced reliance on material possessions. Adopting a minimalist mindset can help you prioritize experiences over things, leading to a more fulfilled and meaningful life.

The Common Reasons To Downsize

There are several reasons why downsizing your home has become a popular choice, especially during retirement. Well, here are some common reasons to downsize.

- One significant benefit is the reduction in property taxes and monthly expenses that come with moving to a smaller residence.

- Additionally, as retirement often leads to empty nesters with extra space, downsizing allows individuals to make better use of their living arrangements.

- Smaller homes also come with the advantage of being easier to clean and maintain, freeing up time for more enjoyable activities.

- Furthermore, downsizing can promote a more minimalist lifestyle, as it requires reducing clutter and belongings, creating a sense of freedom.

How To Start The Process Of Downsizing?

By following the below steps, you can effectively organize your current home and prepare for a successful downsizing transition. Here we go!

- When preparing to downsize your current home, it’s important to start the process by decluttering one room at a time. This allows you to focus on each area and make decisions about what to keep, donate, sell, or discard.

- To create more space in your smaller home, consider using space-saving organizing solutions such as storage bins or shelves.

- Take inventory of sentimental items and determine their importance in your new living space.

- Consider hosting a yard sale or donating unwanted items to help lighten the load. By donating furniture, clothing, and household items, you can give back to your community and benefit those in need.

- Besides, keeping track of the items you donate is important for tax purposes.

- If you need temporary space for your belongings, renting a storage unit can provide a solution.

- Enlisting the help of friends or family members can make the organizing process more manageable and enjoyable. Additionally, seeking advice from professionals experienced in downsizing can offer valuable guidance throughout the process.

Preparing Your Current Home For Sale

- To prepare your house for sale, it’s essential to address any necessary repairs or updates and enhance the curb appeal of your home. This can be achieved by landscaping and maintaining the exterior.

- Remove personal photos and belongings to create a neutral and inviting space.

- Keeping your home clean and tidy for showings and open houses is also important.

- Take the time to research the real estate market in your desired location to understand current trends and pricing.

- Lastly, staying flexible with viewing appointments demonstrates your willingness to accommodate potential buyers.

- Also, consulting with a real estate agent will help you determine the best listing price, ensuring that you maximize your return on investment.

Navigating The Move To A New Location

- To ensure a smooth transition when downsizing to a new location, it’s important to create a comprehensive moving checklist. This will help you stay organized and ensure that no important tasks are overlooked.

- Further, notifying necessary parties of your change of address is crucial. This includes updating your address with the post office, banks, insurance companies, and any other relevant institutions.

- Researching local amenities and services in your new location will also make the move easier. This way, you can find essential facilities such as healthcare providers, grocery stores, and recreational activities.

- When packing, be sure to label boxes strategically for easy unpacking.

- Lastly, don’t forget to update your homeowner’s insurance and utilities for the new property.

Maximizing space in a smaller home

- Take inventory of your belongings

Before you start decluttering, take inventory of your belongings. This will give you a clear picture of what you have and help you identify areas that require decluttering. Create categories for your belongings, such as clothing, books, and kitchen items, and assess each category individually. Keep in mind your new downsized space and only keep items that you truly need or love.

- Sort items into categories

Once you have taken inventory, sort your belongings into categories. Create piles for items you want to keep, donate, sell, or throw away. Be honest with yourself and let go of items that no longer serve a purpose or bring you joy. Remember, downsizing is an opportunity to create a more intentional and clutter-free living space.

- Utilize storage solutions and organization systems

Maximizing space in a smaller home is essential to make the most of your downsizing journey. Invest in practical storage solutions and organization systems that can help you keep your belongings organized and easily accessible. This can include shelves, baskets, and closet organizers. Utilize vertical space and make use of underutilized areas, such as the space under your bed or stairs.

How Does Downsizing Affect Your Retirement Timeline?

Downsizing can have a significant impact on your retirement timeline.

- By freeing up equity, reducing monthly expenses, and decreasing home maintenance costs, downsizing allows you to save more for retirement.

- It provides financial security and flexibility in your retirement plans.

- It is also worth considering investing the proceeds from downsizing into retirement accounts or other income-generating assets.

- To ensure that downsizing aligns with your long-term financial goals, it is advisable to work closely with a financial planner.

Financial considerations of downsizing

- Multi-purpose furniture

When downsizing, every square inch of space counts. Invest in multi-purpose furniture that serves multiple functions. For example, a sofa that can convert into a bed, or a coffee table with built-in storage. By choosing furniture that maximizes functionality, you can save space and create a more versatile living environment.

- Use vertical space

Don’t forget to make use of vertical space in your downsized home. Install shelves or floating cabinets on the walls to display decorative items or store books and other belongings. Hang hooks or racks on doors or walls to hang coats, bags, or towels. By utilizing vertical space, you can free up valuable floor space and create a more organized and spacious feel.

- Create designated storage areas

In a smaller home, it’s important to have designated storage areas for different items. This can help keep your belongings organized and prevent clutter from accumulating. Create specific storage areas for items such as shoes, cleaning supplies, and seasonal clothing. By having designated spaces for everything, you can easily find what you need and maintain a tidy living environment.

Tips for making the decision to downsize

- Emotional attachment to belongings

One of the biggest challenges of downsizing your home is dealing with the emotional attachment to your belongings. Over the years, we accumulate sentimental items that hold memories and meaning. Letting go of these possessions can be difficult and emotionally taxing. It’s important to approach the downsizing process with sensitivity and give yourself time to grieve the loss of certain items. Remember, downsizing is not about getting rid of everything, but rather about intentionally curating your belongings to create a more meaningful and manageable living space.

- Adjusting to a smaller living space

Moving from a larger home to a smaller one requires adjusting to a new living environment. It may take time to get used to the reduced square footage and find creative ways to maximize the space. Downsizing may also require some lifestyle adjustments, such as downsizing furniture or rethinking storage solutions. It’s essential to approach the downsizing process with a mindset of adaptability and flexibility. Embracing the benefits of a smaller home, such as reduced maintenance and lower costs, can help make the adjustment easier.

- Careful planning and consideration

Downsizing your home is not a decision to be taken lightly. It requires careful planning and consideration to ensure that the new home meets your needs and accommodates your lifestyle. Before making the move, take the time to evaluate your current and future needs. Consider factors such as proximity to amenities, accessibility, and the potential for future growth. It’s also important to declutter and organize your belongings before downsizing, to ensure that you only bring with you what you truly need and love.

The Final Say

Downsizing your retirement home is a significant life transition that requires careful planning and consideration.

It can offer several benefits, such as reducing expenses, simplifying your lifestyle, and freeing up time and energy for other activities. However, the process can also be emotionally challenging and overwhelming.

Further, remember to consider the impact on your financial planning and retirement timeline, as well as to avoid cluttering your new home.

With some preparation and a positive mindset, downsizing can be a rewarding experience that allows you to enjoy a more comfortable and fulfilling retirement.

Need expert support in selling your current home and simplifying your downsizing process? You can get in touch with Elite Properties now!