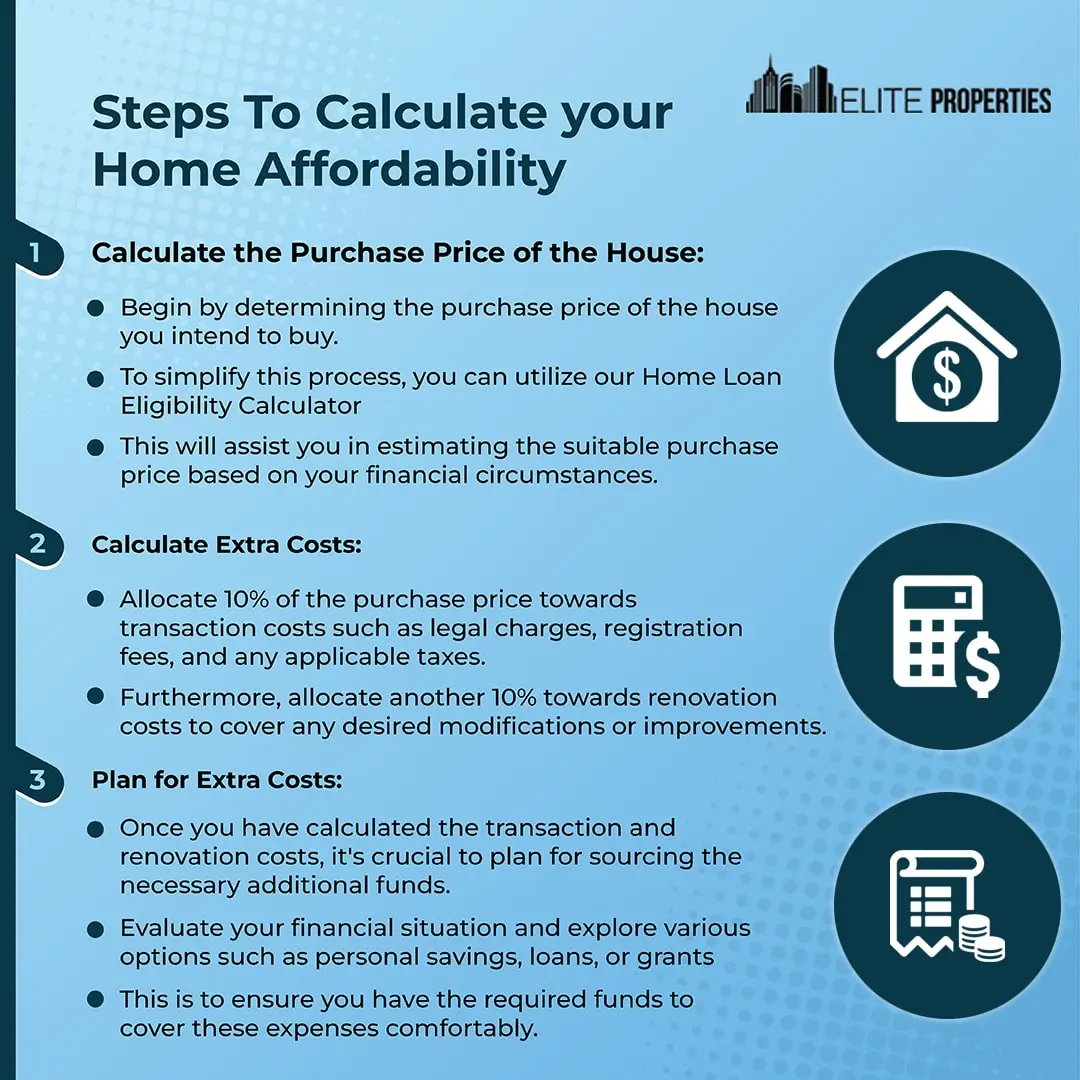

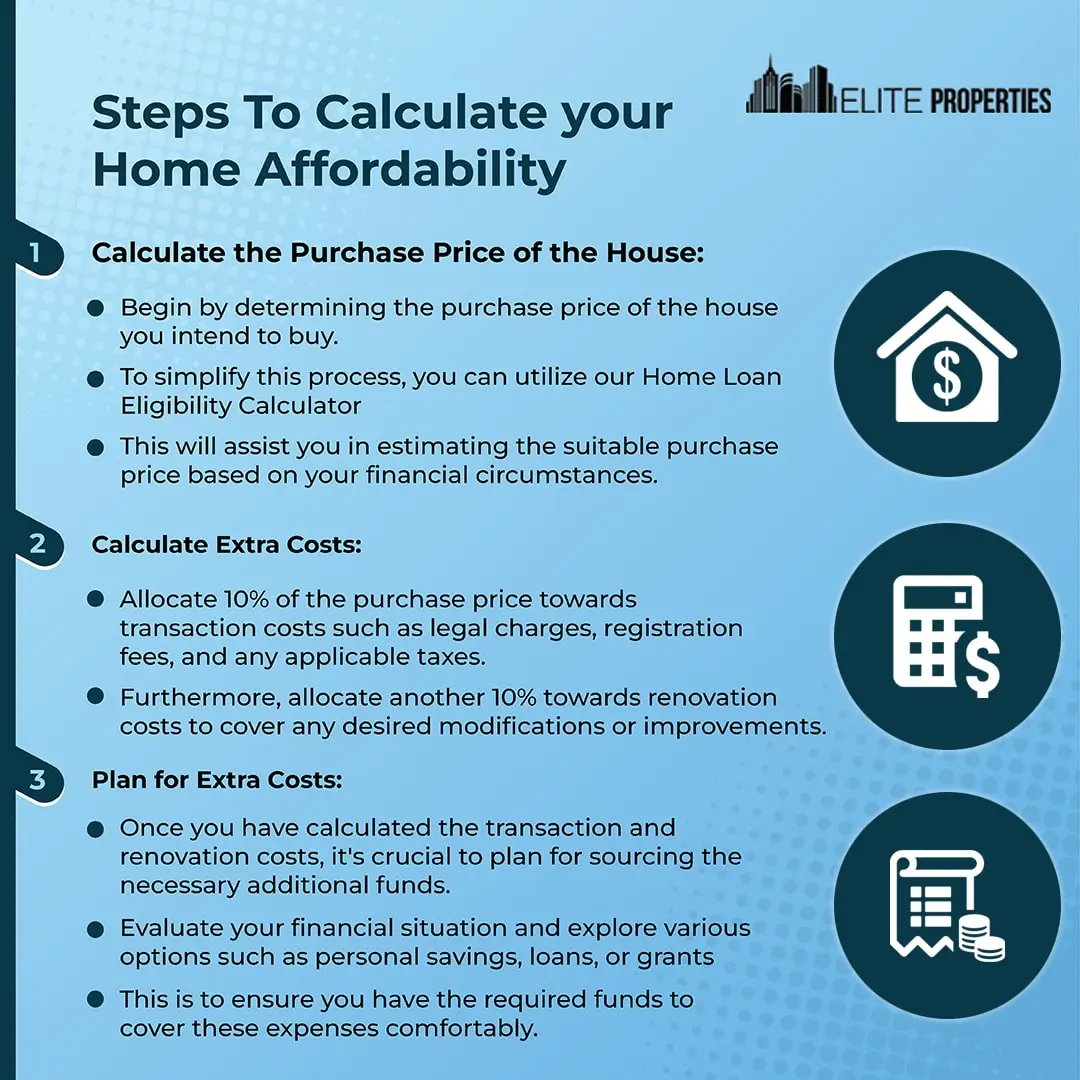

The most significant financial decision you will make in the least is buying a home. It’s an exciting journey to finally own a home, but it can also be overwhelming. You need to consider, What home can I afford? How much can I afford to spend on a house, including the down payment, closing costs, and monthly mortgage payments?

Calculating your budget is crucial to avoiding overspending and financial burden. In this article, we will guide you through the process of calculating your budget so you can determine how much home you can truly afford.

We will cover the different factors that affect your budget, such as your income, debt, credit score, and down payment. By the end of this article, you’ll have a better understanding of your financial situation and be able to confidently make an informed decision when it comes to buying a home.

Why Budgeting is Important in Homebuying?

Before we dive into the specifics of calculating your homebuying budget, it’s important to understand why budgeting is so important in the first place. When you buy a home, you’re committing to a mortgage payment that will likely last 15–30 years. This payment is a significant portion of your monthly expenses, and it’s important to ensure that you can comfortably afford it.

Without a budget, it’s easy to get carried away with the excitement of buying a home and end up in a situation where you’re struggling to make ends meet. By creating a budget, you can determine what you can afford and avoid getting over your head.

Understanding Your Finances: Income, Expenses, and Savings

The first step in calculating your homebuying budget is understanding your finances. There are several factors that effect the your decision of what home can I afford? This means taking a close look at your income, expenses, and savings.

- Income: Your income is the money you earn from your job or any other source, such as rental income or investment income.

- Expenses: Your expenses are all of your monthly bills and other expenses, such as groceries, entertainment, and transportation.

- Savings: Your savings are the money you have saved up in your bank account or other investments.

To determine how much home you can afford, you need to calculate your debt-to-income ratio (DTI). This is the percentage of your monthly income that goes towards paying your debts, including your mortgage payment. Most lenders require a DTI of 43% or lower.

Factors to Consider When Determining How Much House I Can I Afford?

The first step in determining how much house you can afford for deciding what home can I afford? is to consider the various factors that affect your financial situation. These factors include your income, credit score, debt, and expenses.

- Income: Income is the most important factor. Our income determines how much house we can afford. Lenders typically use a debt-to-income ratio (DTI) to determine how much they can afford to borrow.

- Credit Score: Your credit score is another important factor that lenders consider when determining your eligibility for a mortgage. A high credit score helps you get a lower interest rate. This results in the saving of mortgage amounts.

- Debt and Expenses: You should also consider your debt and expenses when determining how much house you can afford. These include car payments, student loans, credit card debt, and other monthly expenses.

Calculating Your Debt-to-Income Ratio (DTI)

To calculate your DTI, you’ll need to add up all of your monthly debts, including your proposed mortgage payment, and divide that number by your gross monthly income. For instance, if your monthly debts amount to $4,000 and your gross monthly income is $20,000, your DTI would be 20%.

Keep in mind that your DTI is just one factor that lenders consider when determining how much home you can afford. They’ll also take into account your credit score, employment history, and other financial factors.

The 28/36 Rule

Another helpful rule of thumb when determining how much home you can afford is the 28/36 rule. This rule suggests that you should spend no more than 28% of your gross monthly income on housing expenses, including your mortgage payment, property taxes, and insurance. Additionally, your total monthly debt payments, including your housing expenses, should be no more than 36% of your gross monthly income.

For example, if your gross monthly income is $6,000, your housing expenses should be no more than $1,680 per month, and your total debt payments should be no more than $2,160 per month.

Types of Home Loans

Now that you have a better understanding of how much home you can afford, it’s time to start thinking about the type of home loan you want. There are several different types of home loans available, including FHA, VA, USDA, and conventional loans.

- FHA loans: FHA loans are popular among first-time homebuyers. It requires a down payment of just 3.5% as it is backed by the Federal Housing Administration. They require a lower down payment and credit score than conventional loans, making them more accessible to those with less-than-perfect credit.

- VA loans: VA loans are available to veterans and active-duty military members and offer competitive interest rates and no down payment requirement.

- USDA loans: USDA loans are backed by the United States Department of Agriculture and are designed to help low- to moderate-income borrowers in rural areas purchase a home. It requires no down payment.

- Conventional loans: Conventional loans are not backed by the government and usually require a higher credit score and down payment than FHA loans.

Government Programs for First-Time Homebuyers

In addition to the types of home loans mentioned above, there are also several government programs available to first-time homebuyers. These programs offer assistance with down payments and closing costs, making it easier for those with limited funds to purchase a home.

The Federal Housing Administration (FHA) offers various programs to assist individuals in purchasing homes. One notable program is the Good Neighbor Next Door program, which provides eligible law enforcement officers, firefighters, emergency medical technicians, and teachers with a 50% discount on the list price of a home in specific designated areas. This program aims to encourage these professionals to live and work in communities that may benefit from their presence.

How Much of a Down Payment Do I Need?

Another important factor to consider when determining how much house you can afford is the down payment. A down payment is the amount of money you pay upfront when purchasing a home. If you spend a large amount as a down payment, that will help you lower your monthly mortgage payment.

The standard down payment is 20% of the purchase price of the home. However, there are options available for those who cannot afford a 20% down payment. For example, the Federal Housing Administration (FHA) offers loans with a down payment as low as 3.5%. Keep in mind that a lower down payment typically means higher monthly mortgage payments and higher interest rates.

Tips for Saving for a Down Payment

Saving a down payment while buying a home is the biggest challenge. These tips will help you:

- Set a savings goal: Determine how much you need to save for a down payment and set a goal for yourself. Ensure sure your goal is realistic and achievable.

- Create a budget: Create a budget to help you track your expenses and identify areas where you can cut back to save more money.

- Automate your savings: Ensure that you are saving money every month, For this, you can set up an automatic transfer from your account to a savings account.

- Consider a side hustle: Consider taking on a side job or freelance work to earn extra money that you can put towards your down payment.

- Look into government programs: There are several government programs that offer assistance to first-time homebuyers, including down payment assistance and grants.

How to Get a Better Interest Rate on Your Mortgage

Once you’ve determined what type of home loan you want, it’s important to do everything you can to get the best interest rate possible. A lower interest rate can save you thousands of dollars over the life of your mortgage.

Some tips for getting a better interest rate include improving your credit score, saving for a larger down payment, and shopping around for the best rates.

Estimating Your Monthly Mortgage Payment

Now that you have a better understanding of the type of home loan you want and the interest rate you can expect, it’s time to estimate your monthly mortgage payment. There are several online calculators available that can help you do this.

Your monthly mortgage payment is the amount of money you pay each month to your lender to repay your mortgage. This payment will consist of several components, including principal, interest, taxes, and insurance. The size of your monthly payment will depend on several factors, including the size of your loan, the interest rate, and the term of your mortgage.

To estimate your monthly mortgage payment, you can use a mortgage calculator. This tool will allow you to enter the purchase price of the house, your down payment, and other factors to determine your monthly payment. Keep in mind that your monthly payment may also include mortgage insurance if your down payment is less than 20%.

Mortgage Affordability Calculators: How They Work and How to Use Them?

Mortgage affordability calculators are a useful tool to help you determine how much house you can afford. These calculators take into account your income, expenses, and debt-to-income ratio to calculate how much you can afford to borrow.

To use a mortgage affordability calculator, you will need to input your income, expenses, and debt information. The calculator will then provide you with an estimate of how much you can afford to borrow. Keep in mind that this is just an estimate, and you will still need to speak with a lender to get pre-approved for a mortgage.

Mortgage Pre-Approval Process: What It Is and Why It Matters?

The most important step in buying a home is getting a pre-approved mortgage. A mortgage pre-approval is a letter from a lender stating that you are pre-approved for a specific amount of money to purchase a home. This letter shows sellers that you are serious about purchasing a home and that you have the financial means to do so.

To get pre-approved for a mortgage, you will need to provide the lender with information about your income, debt, and expenses. While getting a mortgage, the lender will review your application to determine how much you can afford to borrow.

It is not guaranteed that you will get a mortgage, especially if you have a pre-approved mortgage.

Working with a Mortgage Lender

When it comes to getting a mortgage, it’s important to work with a reputable lender who can guide you through the process. A good lender will help you understand your options, answer your questions, and provide you with a clear understanding of the terms and conditions of your loan.

When choosing a lender, consider factors such as their reputation, customer service, and interest rates. Be sure to shop around and compare offers from several lenders to ensure you’re getting the best deal possible.

Other Costs to Consider: Property Taxes, Insurance, and Maintenance

When determining how much house you can afford, it is important to consider other costs beyond your monthly mortgage payment. These costs include property taxes, homeowners insurance, and maintenance expenses.

Property taxes may vary depending on the location where you are living. You can find out the property tax rate for the area you are interested in. This can be done by contacting the local tax assessor’s office. Homeowner’s insurance is another expense that you will need to consider. The cost of homeowners insurance can vary. This depends on the age and condition of the home, as well as the location.

Finally, you will need to consider maintenance expenses when determining how much house you can afford. Homes require regular upkeep and repairs, which can add up quickly. It is recommended that homeowners set aside 1% to 2% of the home’s value each year for maintenance expenses.

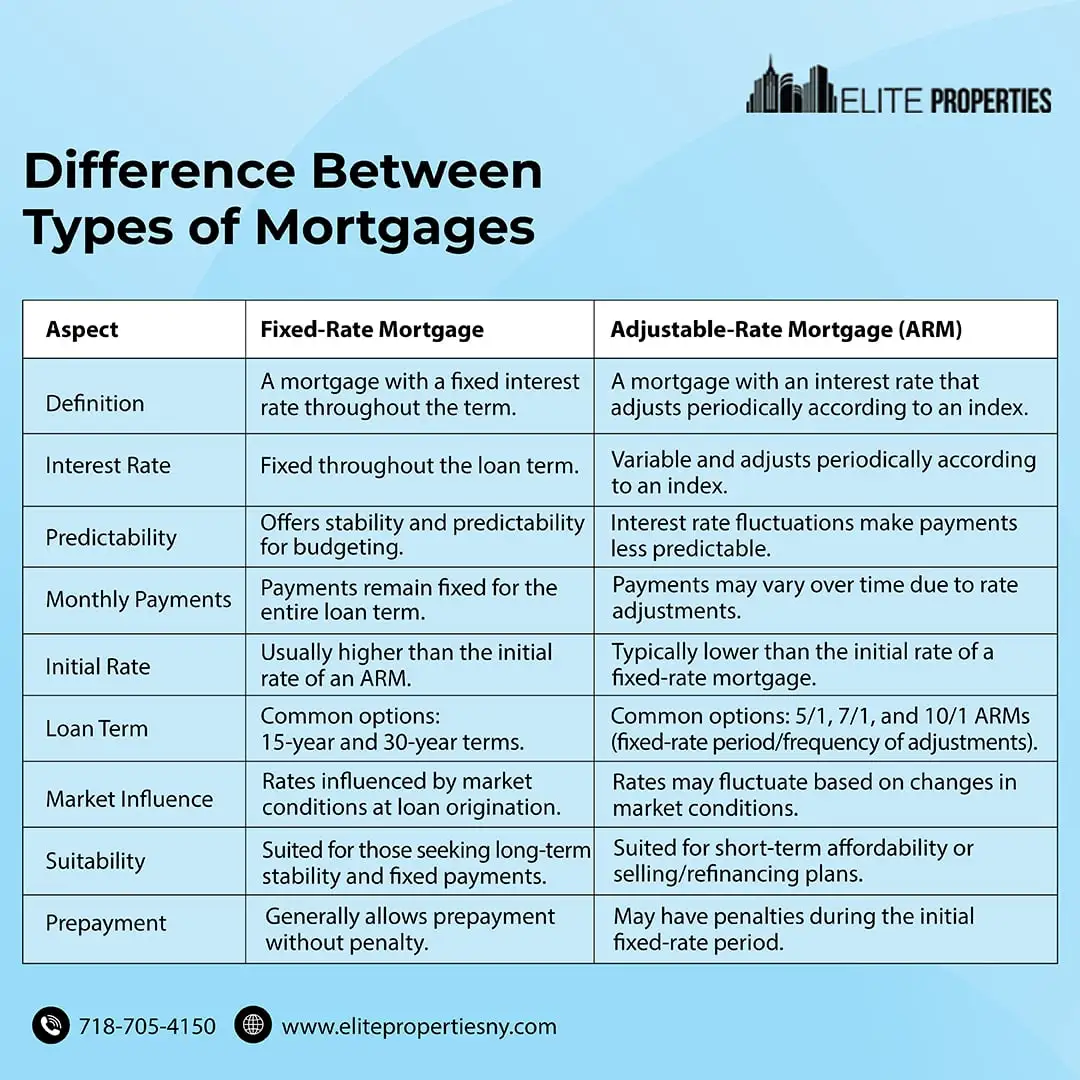

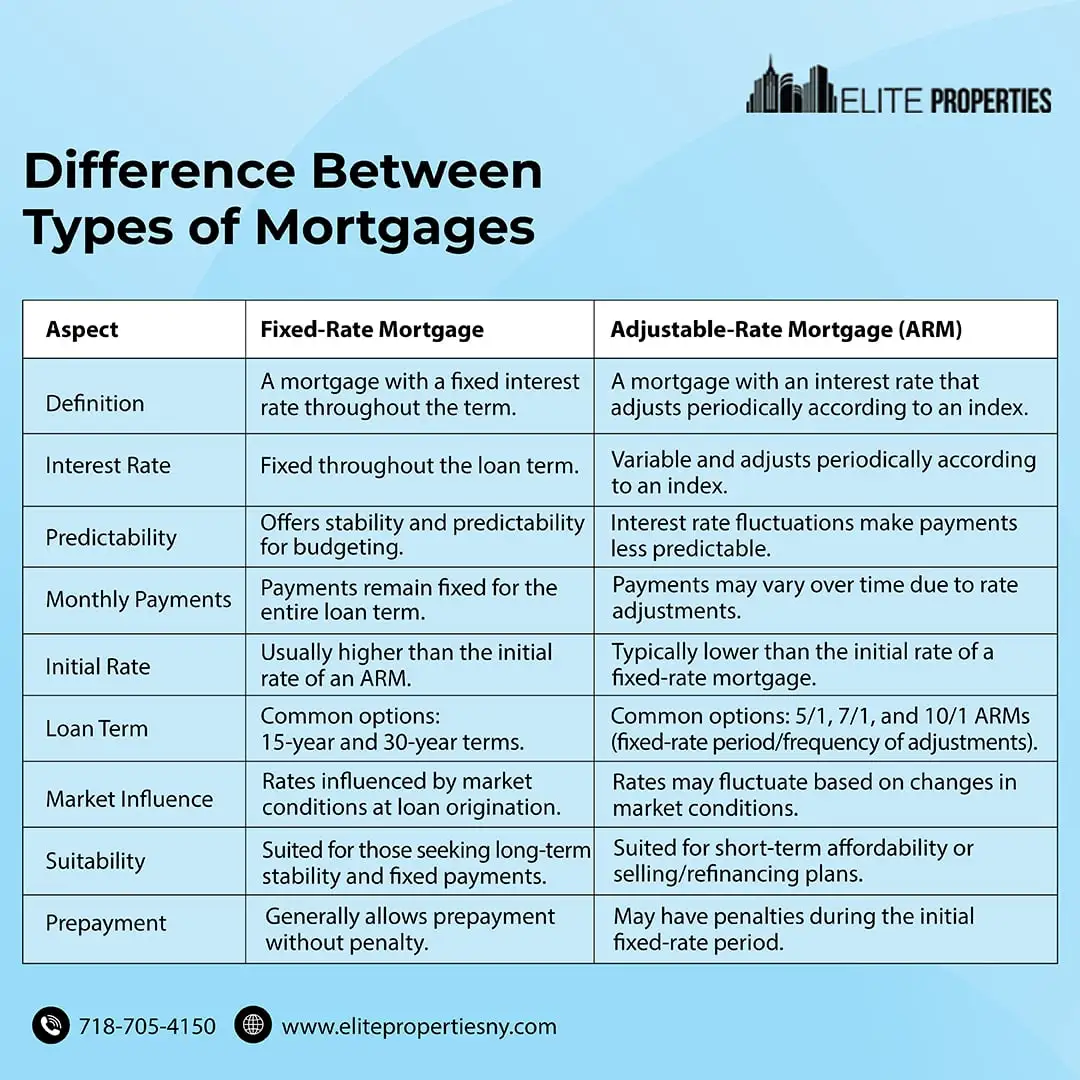

Different Types of Mortgages

There are two main types of mortgages:

- Fixed-rate

- Adjustable-rate.

A Fixed-rate mortgage has a fixed interest rate, irrespective of the tenure of the loan. This means that your monthly mortgage payments will not change over the life of the loan.

An Adjustable-rate mortgage (ARM) is an interest rate that can change over a period of time. ARMs typically have a lower interest rate initially, but the rate can adjust up or down over time.

There is a difference between a fixed-rate and an adjustable-rate mortgage, it is important to consider your financial situation and future plans. A fixed-rate mortgage is a better option if you are staying in your home for a longer time. If you plan to sell the home in a few years, an adjustable-rate mortgage may be a better option.

Tips for Saving Money When Buying a Home

Buying a home is a major financial decision, and it is important to save money where you can. Here are some tips for saving money when buying a home:

- You have to improve your credit score before applying for a mortgage that would be beneficial for you.

- Browsing for the best interest rates and loan terms

- Consider buying a fixer-upper or a home that needs some cosmetic updates

- Negotiate with the seller for a lower price or closing costs

- Choose a smaller home or a less expensive area

Creating Your Homebuying Budget: Additional Expenses to Consider

When creating your homebuying budget, it’s important to take into account additional expenses beyond your monthly mortgage payment. These may include property taxes, homeowner’s insurance, homeowner’s association fees, and maintenance and repair costs.

Revisiting Your Budget: Adjustments to Make Before Closing

As you get closer to closing on your home, it’s important to revisit your budget and make any necessary adjustments. This may include saving more money for your down payment or adjusting your monthly expenses to accommodate your new mortgage payment.

Conclusion

In conclusion, determining how much home you can afford is an important step in the home-buying process. By understanding your finances, calculating your DTI, and following the 28/36 rule, you can get a better idea of what you can afford. Additionally, by taking advantage of government programs and tips for getting a better interest rate. Help you to save money over the life of your mortgage. Remember to stick to your budget throughout the home-buying process to ensure a successful and financially stable homeownership experience.