To hold real estate transactions smoothly, a better understanding of the process and support from experts or professionals is required to solve you real estate FAQs. Whether you are buying a house or selling one, you may be flooded with tons of doubts and queries in your mind at every step.

Getting answers to all such queries and doubts by preparing and educating yourself on how things work helps to easily navigate your real estate transaction with the help of real estate FAQs. In this guide, we have listed and answered some of the most common real estate FAQs that can pop into your mind while buying or selling your home.

So, let’s dive deep into the Real Estate FAQs guide and make it easy for you!

Common Real Estate FAQs When Selling A House

1. What is a Seller’s market?

A seller’s market, there’s a scarcity of goods up for grabs, granting sellers the upper hand in setting prices. This term is often used in the real estate when there’s a low supply and eager buyers.

2. How long will it take to Sell My House, a most important Real Estate FAQs?

A house generally takes 55 to 70 days to sell. This comprises 25 days on market and a 30- to 45-day closing period. Research shows that, as of March 2023, on average, it can take 54 days to sell your home. However, the exact answer to how long will it take to sell your house ultimately depends on certain factors such as the condition of the house itself, the real estate market conditions in your area, the time of the year that you are listing, property location, and the asking price.

3. What are some Effective Pricing Strategies for Selling a home?

Pricing your home correctly is crucial to attract buyers and sell it within a reasonable timeframe. One effective strategy is to price your home competitively based on comparable properties in your area. Overpricing can deter potential buyers, while underpricing may result in leaving money on the table. Another strategy is to consider the current market conditions. If it’s a seller’s market with limited inventory, you may be able to set a higher asking price. However, in a buyer’s market with more competition, pricing slightly below market value can generate more interest and potentially lead to multiple offers.

4. How do I prepare my house before Selling?

Making your house presentable is the first step in getting ready to sell. This entails doing minor repairs and thoroughly cleaning the entire house. Help customers in ensuring the proper functioning of the HVAC, plumbing, and electrical systems. Every room should appear tidy, uncluttered, and free of obvious damage. Alternatively, you can also consider professional staging which can help buyers envision themselves living in the home

5. How to determine the Selling Price of my house?

The neighborhood and the asking price of comparable-sized homes are some of the most important factors to consider while determining a house’s selling price. Getting a thorough comparative market analysis from a local realtor is one of the best ways to determine whether you are selling your house for the proper price. Also, check the age and condition of your house which will affect the property value. Yet the market is important. Just like anything else, supply and demand affect how much a property costs.

6. What are the documents that the buyer will need from me?

The original Title Deed, Sale Deed, Encumbrance Certificate, and any relevant tax receipts could be requested by a buyer while selling your home.

7. How can I navigate the Negotiation Process when Selling My Home?

Negotiating the sale of your home can be a delicate process. It’s important to approach negotiations with a clear understanding of your priorities and be open to compromise. Work closely with your real estate agent to determine your bottom line and set realistic expectations. Consider factors such as the current market conditions, the buyer’s offer, and any contingencies. Your agent will help you negotiate the best possible terms and guide you through counteroffers and potential repairs requested by the buyer. Remember, the goal is to reach a mutually beneficial agreement that satisfies both parties.

8. Another Real Estate FAQs, What is the Commission Paid to an agent?

Instead of receiving a fixed fee, the seller generally pays the agent through a commission in a real estate transaction. The commission charge often amounts to 5–6% of the ultimate sale price of the house. The commission fee is usually split equally between the agents representing the seller and the buyer each taking home 2.5–3%.

9. Why does the Assessed Value of my house vary from its Market Value?

Your home’s market value can be more than its assessed value in a seller’s market. This is a result of low availability, which makes buyers willing to pay more than the house is technically worth. On the other hand in a buyer’s market, because there will be a lot of competition from other sellers, buyers may make an offer that is less than the home’s assessed value.

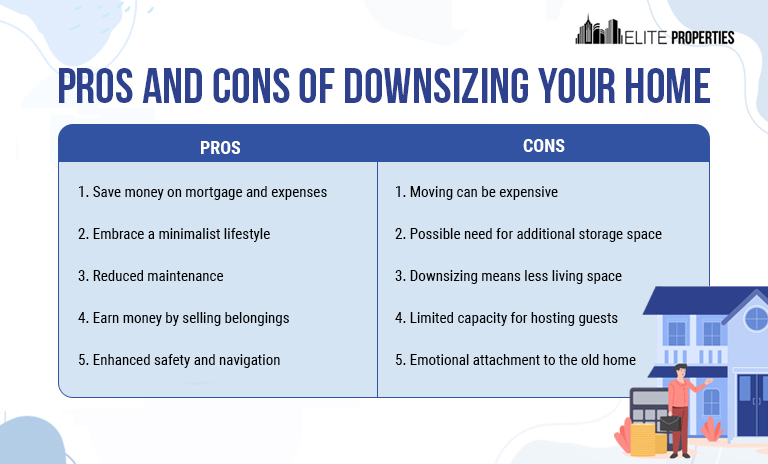

10. Should I consider a Fixer-Upper or a Move-In Ready Home?

The choice between a fixer-upper and a move-in ready home depends on your personal preferences, budget, and willingness to take on renovation projects. Fixer-uppers can offer great potential for customization and increased equity, but they require time, money, and effort to bring them up to your standards. Move-in ready homes, on the other hand, are ready for immediate occupancy but may have a higher price tag. Consider your renovation skills, availability of funds, and timeline when deciding which option is best for you.

Pricing Strategies For Selling a Home Real Estate FAQs

1. What is a Comparative Market Analysis, and how does it help determine the right listing price?

A comparative market analysis (CMA) is a tool used by real estate agents to determine the appropriate listing price for a home. It involves analyzing recent sales of similar properties in the area, taking into account factors such as location, size, condition, and amenities. The CMA provides valuable insights into the current market conditions and helps identify a price range that will attract potential buyers. By comparing your home to recently sold properties, you can ensure that your listing price is competitive and reflective of the market value.

2. What are the advantages of pricing slightly below market value?

Pricing your home slightly below market value can create a sense of urgency among buyers and generate more interest. It can lead to multiple offers and potentially result in a higher final sale price. Buyers often perceive homes priced below market value as a great deal and are more motivated to submit competitive offers. This strategy can also help your home stand out among the competition and attract a larger pool of potential buyers. However, it’s important to consult with your real estate agent to determine if this strategy is appropriate for your specific market and property.

3. How can I attract Potential Buyers in a competitive market?

In a competitive market, it’s essential to make your home stand out to attract potential buyers. Start by ensuring your home is in excellent condition and address any necessary repairs or updates. Consider offering incentives such as a home warranty, seller-paid closing costs, or a flexible closing timeline. Additionally, invest in professional staging and high-quality photography to make your listing visually appealing. Finally, work closely with your real estate agent to develop a comprehensive marketing plan that includes online listings, social media promotion, and targeted advertising. These strategies will help increase visibility and attract serious buyers.

4. What are Closing Costs?

Closing cost refer to additional charges beyond the property’s purchase price that both buyers and sellers need to cover to finalize a real estate deal. These expenses can comprise various fees such as loan initiation charges, property valuation fees, title examinations, title protection, land surveys, taxes, deed registration expenses, and fees for credit reports.

Expert Tips On Preparing a Home For Sale For Real Estate FAQs

1. How can Staging my home help sell it faster?

Staging your home can significantly impact how potential buyers perceive the space. It involves arranging furniture, adding decorative elements, and creating a welcoming atmosphere that showcases the home’s best features. Staging helps buyers envision themselves living in the space and can make a significant difference in how quickly your home sells. Professional staging companies can provide guidance on furniture placement, color schemes, and accessories that will appeal to a wide range of buyers. If hiring a professional stager is not an option, you can still make small improvements by decluttering, rearranging furniture, and adding fresh flowers or plants.

2. What are some Cost-Effective ways to increase curb appeal?

Curb appeal plays a vital role in attracting potential buyers to your home. Fortunately, there are several cost-effective ways to enhance the exterior of your property. Start by cleaning up the yard, mowing the lawn, and trimming overgrown bushes or trees. Add pops of color by planting flowers or placing potted plants near the entrance. Make sure the exterior of the home is clean and in good repair – consider power washing the siding, repainting the front door, and replacing outdated light fixtures. Lastly, don’t overlook the small details – ensure the house numbers are clearly visible, and the mailbox is in good condition.

3. Should I hire a Professional Photographer to showcase my home?

In today’s digital age, high-quality photographs are essential for attracting potential buyers online. Professional photographers have the skills and equipment to capture your home in the best possible light. They know how to showcase the home’s features, create inviting images, and make the space appear larger. Hiring a professional photographer is especially important if you have unique architectural elements, stunning views, or a well-designed interior. The investment in professional photography can significantly impact the number of showings and the speed at which your home sells.

Common Real Estate FAQs When Buying A House

1. What is a Buyer’s Market?

In a buyer’s market, purchasers hold the upper hand over sellers due to an abundance of supply compared to demand. Consequently, prices tend to remain depressed, offering buyers a plethora of choices while compelling sellers to maintain competitive pricing. This scenario grants buyers greater leverage in negotiations.

2. What are the first steps in the Home Buying Process?

The home buying process can feel overwhelming, but understanding the first steps can help ease your concerns. The first thing you should do is determine your budget and get pre-approved for a mortgage. This will give you a clear idea of how much you can afford to spend on a home. Next, start researching neighborhoods and make a list of your must-haves and deal-breakers. Once you’ve done your research, it’s time to find a real estate agent who can guide you through the rest of the process. They will help you find suitable properties, negotiate offers, and navigate the closing process.

3. How can I finance my Home Purchase?

Financing a home purchase is a crucial aspect of the home buying process. There are several financing options available, but the most common ones are conventional loans, FHA loans, and VA loans. Conventional loans are not backed by the government and typically require a higher credit score and down payment. FHA loans are insured by the Federal Housing Administration and are more accessible to buyers with lower credit scores and smaller down payments. VA loans are available to veterans and active-duty military personnel and often require no down payment. It’s essential to speak with a mortgage lender to determine which option is best for you.

4. What’s the average credit score I need to buy a home?

Most loan programs need a FICO score of 620+. Higher scores mean less risk for lenders, offering perks like lower down payments and better rates. On the contrary, lower scores might mean higher upfront amounts or interest rates to mitigate the lender’s perceived risk.

5. What factors should I consider when buying a home?

When buying a home, several factors should be taken into consideration. Location is one of the most critical factors. Consider the proximity to schools, work, amenities, and transportation. Safety is also crucial, so research crime rates and neighborhood statistics. Additionally, think about the size and layout of the home. Does it meet your current and future needs? Don’t forget to consider the condition of the property, including any necessary repairs or renovations. Lastly, evaluate the potential for appreciation and resale value. Taking these factors into account will help you make an informed decision.

6. Should I Sell My Current House to Buy a New One?

It mostly depends on your financial situation and capacity to locate temporary housing. It is advisable to sell your current house before buying a new one if you require additional equity to buy a new house or to satisfy a mortgage requirement. Having said that, you will probably require temporary housing or a short-term rental elsewhere.

7. What should I do when I want to Buy a House?

Getting a mortgage approved is the first and foremost stage in the home-buying process. Buying a new house will be extremely difficult without a mortgage approval. Most people don’t have sufficient funds to buy a house altogether. Therefore, a mortgage functions as a safe loan that has a fixed interest rate.

8. Am I required to do a Home Inspection?

An expert inspector can provide feedback on any local code concerns as well as structural and aesthetic concerns. A house inspector will also assist you in valuing the house more accurately.

9. How does the Home Inspection Process work?

The home inspection is a crucial step in the home buying process. It involves hiring a professional home inspector to assess the condition of the property. The inspector will examine the home’s structure, systems, and components, including the roof, foundation, electrical, plumbing, and HVAC systems. They will identify any potential issues or defects that could affect the property’s value or safety. After the inspection, you will receive a detailed report outlining the inspector’s findings. This report will help you make an informed decision about whether to proceed with the purchase, negotiate repairs, or request a credit from the seller.

10. What are some common red flags to look for during a home inspection?

During a home inspection, there are several red flags that buyers should be aware of. Some common issues include water damage, mold, structural problems, faulty electrical wiring, plumbing leaks, and signs of pest infestation. These issues can be costly to repair and may indicate more significant problems with the property. It’s important to carefully review the home inspection report and discuss any concerns with your real estate agent. They can help you determine if the issues are deal-breakers or if they can be addressed through negotiations with the seller.

11. What time of the year is best to buy a home?

It depends on whether your goal is to find the best deals or a broad spectrum of options. A 2016 analysis indicates that November is the best time to locate a decent deal, while April is the most active month for new listings. August appears to be a good middle month, with affordable pricing and a large number of available properties.

12. What is an Earnest Money Deposit?

A buyer makes a deposit to a seller as an indication of their good faith or assurance of interest in purchasing the house. Earnest money is not always refundable. However, as long as buyers do not breach any agreements and follow decision deadlines, they often receive their earnest money back.

13. How much Down Payment do I need to pay to buy a house?

Ideally, you can avoid paying private mortgage insurance (PMI) by making a 20% down payment; however, in practice, lenders typically want a minimum of 3% in order for the sale to proceed. Certain lenders could demand a minimum of 5%, depending on your location and the type of mortgage you qualify for.

Real Estate FAQs Related to Financing Options For Home Buyers

1. What is a Mortgage?

Before buying a home, most people need a mortgage, where they borrow money from a lender using the property as collateral. The mortgage agreement details terms like loan amount, interest rate, and repayment period.

2. What are the pros and cons of Conventional loans for real estate FAQs?

Conventional loans have both advantages and disadvantages. One of the main benefits is that if you have a high credit score and a substantial down payment, you may be eligible for a lower interest rate. Additionally, conventional loans do not require mortgage insurance if you make a down payment of at least 20%. However, these loans usually require a higher credit score compared to government-backed loans, and the down payment requirements can range from 3% to 20% of the purchase price. It’s essential to weigh these factors and consider your financial situation before deciding on a conventional loan.

3. How do FHA loans work, and who qualifies for them?

FHA loans are a popular choice for first-time homebuyers and those with lower credit scores. These loans are insured by the Federal Housing Administration and are more accessible to borrowers who may not qualify for conventional loans. FHA loans typically require a down payment of 3.5% of the purchase price and have more lenient credit score requirements. However, keep in mind that FHA loans require mortgage insurance premiums, which can increase your monthly payments. To qualify for an FHA loan, you must meet certain criteria, including having a steady income and a debt-to-income ratio within acceptable limits.

4. What are the benefits of VA loans for military personnel?

VA loans offer several advantages for veterans and active-duty military personnel. One of the main benefits is that VA loans often do not require a down payment, making homeownership more accessible. Additionally, VA loans do not require private mortgage insurance, which can save borrowers a significant amount of money each month. These loans also have more lenient credit requirements compared to conventional loans. It’s important to note that VA loans are only available to eligible veterans and military personnel and may have limitations based on service history and length of service.

5. What is Earnest Money?

Earnest money, often referred to as a good faith deposit, is a sum of money provided by a buyer to demonstrate their serious intent to purchase a property. It is usually 1-2% of the home’s price, held in escrow.

How To Navigate The Negotiation Process an Real Estate FAQs

1. Why is it important to respond promptly to offers?

When selling a home, responding promptly to offers is crucial for several reasons. First, it shows potential buyers that you are serious about selling and willing to engage in negotiations. Prompt responses demonstrate professionalism and can help build trust between you and the buyer. Additionally, delaying your response may give the impression that you are not motivated to sell or that you have received better offers. In a competitive market, delaying your response can result in missed opportunities and potential buyers moving on to other properties.

2. What should I consider when Reviewing Offers?

When reviewing offers, it’s essential to consider more than just the purchase price. Evaluate the terms and contingencies outlined in each offer. Look for offers with favorable financing terms, such as a substantial down payment or a pre-approval letter from a reputable lender. Consider the proposed timeline for inspections, appraisals, and closing. Assess any contingencies, such as the sale of the buyer’s current home or the need for repairs. Your real estate agent will help you review and compare offers, weighing the pros and cons of each to determine the best course of action.

3. How can a Counteroffer benefit me as a seller?

A counteroffer allows you, as the seller, to propose alternative terms to the buyer’s initial offer. It gives you an opportunity to negotiate and potentially secure more favorable terms or a higher purchase price. Counteroffers can be used to address concerns or contingencies outlined in the buyer’s offer. It’s important to work closely with your real estate agent to determine the appropriate counteroffer strategy. They will help you navigate the negotiation process, advise on potential repairs or credits, and ensure that your interests are protected throughout the transaction.

The Importance Of Working With a Real Estate Professional

1. Why should I work with a Real Estate Professional when buying or selling a home?

Working with a real estate professional provides numerous benefits when buying or selling a home. Professionals have extensive knowledge of the local market and can provide valuable insights into pricing, neighborhoods, and market trends. They have access to a wide range of resources and can help you find suitable properties or attract potential buyers. Professionals are skilled negotiators and will advocate for your best interests throughout the transaction. Whether you’re buying or selling, a real estate Professional will guide you through the process, handle paperwork, and ensure a smooth and successful transaction.

2. How do I choose the right Real Estate Professional an another Real Estate FAQs?

Choosing the right real estate professional is crucial for a successful home buying or selling experience. Start by asking for recommendations from friends, family, or colleagues who have recently worked with.

Conclusion

Real estate transactions are often complex, and it’s essential to have a clear understanding of the process to make informed decisions. That’s why we’ve compiled this real estate FAQs list. We have address common concerns and provide expert answers that will guide you through your real estate journey. Whether you’re a first-time buyer or an experienced seller, these frequently asked questions will give you the information you need to navigate the market successfully.