If you are a homeowner simply looking to get home insurance, you may have heard about a 4-point inspection. But what exactly is it, and is it necessary?

A 4-point inspection is a specialized type of home inspection that evaluates four important areas of the property – roofing, HVAC systems, electrical systems, and plumbing connections.

Most insurance providers mandate this inspection to ensure the safety and longevity of the home’s critical elements.

Regular home maintenance is crucial to prevent significant problems from occurring in the future. 4-point inspection can help identify issues early, saving a great deal of money. It can ensure that your home is in top condition and ultimately help to increase its overall value.

Let’s explore more about a 4-point inspection, including what it means, what it covers, how much it costs, how it differs from a full home inspection, and so on.

Keep reading!

What Is A 4-Point Inspection?

A 4-point inspection is a comprehensive evaluation of a home’s four major systems- HVAC, electrical, roofing, and plumbing.

While applying for home insurance, a homeowner may often need to submit the right expert inspection report for their property. Generally, this inspection is required for home insurance policies, which determine the system’s integrity and major components.

As a result, this becomes essential to get your home insured by the insurance company, as it can primarily help to identify concealed problems if any with the four mentioned systems.

This inspection is common for older properties, sometimes it is quick and might provide you with additional choices for home insurance. Some insurers require it for houses over 20 or more years old before offering policies to avoid increased liability. The inspector will go over what has to be changed or replaced to address issues if a home fails all or part of the inspection. Such repairs are essential to get insurance.

Why is a 4 point inspection important?

- For potential homebuyers, a 4 Point Inspection is essential for insurance purposes.

- Many insurance companies require this inspection before offering coverage on older homes or homes with outdated systems.

- By understanding the condition of the property’s vital components, insurers can determine the level of risk involved and customize insurance policies accordingly. This helps protect both the homeowner and the insurance company from potential liabilities.

- For homeowners looking to sell, a successful 4 Point Inspection can offer peace of mind to potential buyers and potentially speed up the sale process.

- By knowing that the home’s critical systems are in good shape, buyers are more likely to feel confident about their investment. This can lead to quicker negotiations and a smoother transaction.

What Does 4 Point Inspection Cover?

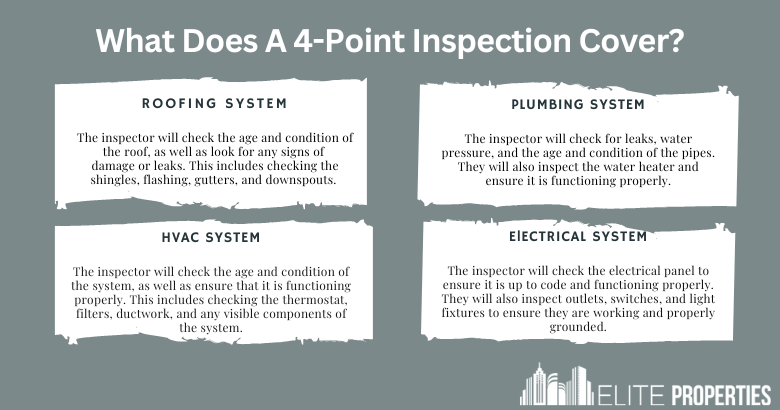

A 4-point inspection is a detailed examination of a home’s current health that covers four primary systems: roofing, plumbing, HVAC, and electrical.

Things covered in a 4 point inspection of home.

It is essential for both the homeowner and insurer to identify potential issues and ensure that the property is up to par with the latest codes and standards. A 4 Point Inspection focuses on four key areas of a home: the roof, electrical system, plumbing system, and HVAC system. Let’s take a closer look at each of these components and what they entail:

1. Roofing

- The roofing section of the inspection covers a review of visible defects in eaves, soffits, shingles, and other roofing materials.

- The inspector will assess the overall condition of the roof, including its age, materials used, and signs of damage or wear.

- They will check for missing or damaged shingles, leaks, and signs of water damage.

- The roof’s structural integrity and potential risks, such as mold or pest infestations, will also be evaluated.

2. Plumbing System

- This covers examining the age of your water heater, the type and material of the plumbing systems in your house, and any leaks that might be present.

- The plumbing system inspection covers the entire plumbing infrastructure of the house, including water supply lines, drains, and fixtures.

- The inspector will check for leaks, water pressure issues, signs of corrosion, and potential plumbing code violations.

- They may also evaluate the functionality of fixtures such as toilets, sinks, and showers.

3. HVAC System

- This includes inspecting the type and presence of heating, ventilation, and air conditioning systems within the home, also considering the age, and condition of these systems, and any indications of leaks or other damages.

- The inspector will examine the age and condition of the HVAC unit, check for proper installation and functionality, and assess the overall efficiency of the system.

- They may also inspect the ductwork and filters for cleanliness and potential issues.

4. Electrical System

- This involves determining the type of wiring, the brand of the main panel, and the general state of the system, including any additional electrical components.

- The inspector will check for outdated or unsafe wiring, overloaded circuits, and potential fire hazards.

- They may also verify the presence of ground fault circuit interrupters (GFCIs) in appropriate areas, such as bathrooms and kitchens.

What to expect during a 4 point inspection?

A 4 Point Inspection is a comprehensive assessment that requires attention to detail and expertise. Here’s what you can expect during the inspection process:

- Scheduling: Once you’ve decided to proceed with a 4 Point Inspection, you’ll need to schedule an appointment with a qualified inspector. It’s essential to choose an inspector with relevant experience and certifications to ensure a thorough evaluation.

- Preparation: Before the inspection, it’s important to ensure access to all areas that will be assessed. Clearing any obstructions, unlocking doors, and providing necessary documentation, such as permits or maintenance records, can help streamline the process.

- Inspection: The inspector will arrive at the scheduled time and begin the assessment. They will systematically evaluate each of the four areas, documenting their findings and taking notes or photographs as necessary. The inspection may take several hours, depending on the size and complexity of the property.

- Report: Once the inspection is complete, the inspector will provide a detailed report outlining their findings. This report will typically include descriptions of any issues or concerns identified, as well as recommendations for repairs or further evaluation by specialists, if needed.

- Review and Negotiation: If any significant issues are discovered during the inspection, it’s crucial to review the report thoroughly. Depending on the nature of the findings, you may need to negotiate repairs or adjustments to the sale price with the seller. Your real estate agent can guide you through this process.

Common issues found during a 4 point inspection

A 4 Point Inspection can uncover various issues that may affect the overall condition and safety of a home. Some common issues include:

- Roof Leaks: Leaks or signs of water damage on the roof can indicate structural issues or the need for repairs or replacement.

- Electrical Wiring Problems: Outdated or unsafe wiring, overloaded circuits, and improper installations can pose fire hazards or electrical malfunctions.

- Plumbing Leaks and Water Damage: Leaky pipes, clogged drains, and water damage can lead to mold growth, structural damage, and costly repairs.

- HVAC System Inefficiency: An inefficient HVAC system can result in higher energy bills, poor indoor air quality, and discomfort.

- Code Violations: Non-compliance with building codes, such as improper venting or inadequate insulation, may require corrective actions to meet safety standards.

It’s important to address any issues promptly to ensure the safety and integrity of the home.

How to address issues found during a 4 point inspection?

If significant issues are uncovered during a 4 Point Inspection, it’s essential to address them promptly and effectively. Here’s a step-by-step approach to tackling these issues:

- Evaluate the findings: Review the inspection report in detail and seek clarification from the inspector if needed. Understand the severity and potential implications of the identified issues.

- Obtain repair estimates: Obtain estimates from licensed contractors for the necessary repairs or replacements. It’s advisable to get multiple quotes to compare costs and ensure competitive pricing.

- Negotiate with the seller: If you’re a potential buyer, discuss the inspection findings with your real estate agent and negotiate with the seller. Depending on the nature and cost of the repairs, you may request that the seller handle them or adjust the sale price accordingly.

- Prioritize safety: Address any safety-related issues first. Issues that pose immediate risks to the occupants or the property, such as faulty electrical wiring or a leaking roof, should take precedence.

- Budget for repairs: Create a budget and timeline for completing the necessary repairs. Consider the urgency of each issue and allocate funds accordingly.

- Hire qualified professionals: Engage licensed and reputable contractors to carry out the repairs or replacements. Ensure they have the necessary expertise and provide warranties for their work.

- Document the repairs: Keep records of all repairs and replacements, including invoices, receipts, and warranties. This documentation will be valuable for insurance purposes and future reference.

By addressing issues promptly and effectively, you can ensure the safety, functionality, and value of your home.

How Much Is A 4 Point Inspection Cost?

The cost of 4 point inspection can vary from state to state and depends on the insurance company too.

However, you can estimate its cost between $50 and $150, depending on the size and location of the property. You may consider $50 for a lower-end price, $100 for an average cost, and $150 for a higher end.

Your home inspector may also provide you with an inspection at no cost along with your regular home inspection if you are someone buying a house that is old.

A 4-point inspection less than three years old can be used again when you switch insurance companies.

How long does a 4 point inspection take? an answer to the question is 30 to 40 min on site. It can be done quickly by the professional.

4 Point Inspection Vs. Full Inspection

Now, let’s dive into how a 4-point inspection differs from a full home inspection to better understand the concept.

- Coverage

4-point inspections are concentrated assessments that concentrate on four areas such as the electrical system, plumbing, roofing, and HVAC systems of a house. Full home inspections, often known as buyer’s inspections, are thorough examinations covering nearly all of a home’s visible spaces. - Time Consumed

While a 4-point inspection generally takes about an hour depending on the complexity and size of the property. As obvious, a buyer’s inspection comparatively takes more time as it is a detailed inspection of all the aspects of a house unlike a 4-point inspection, which only checks four things. - Purpose

Another major difference is that 4-point inspections can be far more common and are typically useful to get insurance. Full home inspections normally take place for the sale of a home. In the case of a full home inspection, the underlying goal of the inspector is to help buyers determine whether to spend on a particular property or not. - Request

A full home inspection is requested by the buyer of a property, while the 4-point inspection is requested by the insurance company for issuing or renewing your home insurance policy.

What Is A 4 Point Inspection For Home Insurance Coverage?

For insurance companies, a 4 Point Inspection provides valuable information about the condition and potential risks associated with a property’s critical systems. Based on the inspection findings, insurers can assess the level of risk involved in insuring the home and customize insurance policies accordingly.

If significant issues are identified during the inspection, such as an outdated electrical system or a deteriorating roof, insurance companies may require repairs or replacements before providing coverage. This ensures that the home meets certain safety standards and reduces the likelihood of claims related to these critical systems.

On the other hand, a successful 4 Point Inspection can result in more favorable insurance premiums and terms. If the home’s vital components are deemed to be in good condition and pose minimal risk, insurance companies may offer more competitive rates and broader coverage options.

If Your House Fails A 4-point Inspection, Can You Still Get Insurance?

This is yet an important question whether you will get insurance in case your house fails this inspection. The consequences usually depend on how the insurance companies respond. Also, the way insurance companies respond to problematic houses varies.

While some insurance providers won’t cover these problematic properties at all, others adopt a different strategy. There are insurance providers who provide insurance but don’t cover the unreliable system.

Hiring a qualified inspector for a 4 point inspection

When it comes to a 4 Point Inspection, it’s crucial to hire a qualified inspector with relevant experience and certifications. Here are some tips for finding the right inspector:

- Research: Start by researching reputable inspection companies or individual inspectors in your area. Check their websites, online reviews, and credentials to ensure they meet industry standards.

- Certifications: Look for inspectors who hold certifications from recognized organizations, such as the International Association of Certified Home Inspectors (InterNACHI) or the American Society of Home Inspectors (ASHI).

- Experience: Inquire about the inspector’s experience specifically with 4 Point Inspections. A seasoned professional will have a better understanding of the unique requirements and potential issues associated with these assessments.

- References: Ask for references from previous clients to get a sense of the inspector’s professionalism, thoroughness, and ability to communicate findings clearly.

- Insurance: Verify that the inspector carries professional liability insurance, also known as errors and omissions (E&O) insurance. This coverage protects you and the inspector in the event of any errors or omissions during the inspection process.

Tips for preparing for a 4 point inspection

To ensure a smooth and thorough 4 Point Inspection, consider the following tips:

- Make necessary repairs: Address any known issues or repairs before the inspection. This includes fixing leaky faucets, replacing broken light fixtures, and repairing damaged shingles.

- Clear access: Ensure that the inspector has easy access to all areas that will be evaluated. Clear any clutter, unlock doors, and provide access to attics, crawl spaces, and utility rooms.

- Gather documentation: Organize any relevant documentation, such as permits, maintenance records, or warranties, that may be useful during the inspection.

- Ask questions: Don’t hesitate to ask the inspector questions about their findings or recommendations. A good inspector will be happy to explain their observations and offer guidance.

- Follow up: If the inspector recommends further evaluation by specialists, such as a licensed electrician or plumber, make arrangements to address these concerns promptly.

By being proactive and prepared, you can ensure a more efficient and productive 4 Point Inspection process.

The Final Say

A 4-point inspection for homeowners is a detailed inspection that includes the roofing, HVAC system, electrical and plumbing systems. It is important to perform regular home maintenance to prevent major issues from arising.

Make sure to select a qualified inspector with experience who can carry out this kind of inspection accurately. In the long run, doing your homework beforehand can save you time and money!

You can also seek more information on this from Elite Properties. We are a New York-based real estate company that thoroughly believes in giving top-notch real estate services to its clients. Get in touch now!

What are Closing Costs and How Much Do Sellers Usually Pay?

When it comes to selling a home, you need to consider a plethora of expenses, including closing costs, which can burn a hole in your pocket. Closing costs are fees that come up during the finalization of a real estate transaction and have to be paid by both the buyer and the seller. The charges usually include appraisal fees, title search fees, survey fees, and more. Don’t just guess, here is the blog where you would get to know how much are closing costs for a seller is.

As a seller, you may have to bear a significant portion of these expenses. So, it’s crucial to know how much you need to shell out and what you’re getting into. Therefore, in this blog post, we’ll delve deeper into closing costs, including their definition, how much you can expect to pay, and why they are a crucial aspect of a home sale.

Selling a home is a major life event that requires careful planning and budgeting. One of the things that sellers need to be aware of is closing costs. These fees can be a real headache and vary in cost depending on the property size and location.

So what are closing costs, you ask? Essentially, they’re the fees associated with the sale of a home. As a seller, you’re responsible for paying a range of costs, which can add up to a hefty sum. In some cases, closing costs can be in the thousands of dollars!

The good news is that you can minimize your closing costs by understanding which fees you’re expected to pay. Generally, sellers can expect to pay between 1% and 3% of the home’s sale price in closing costs. For example, if your home sells for $300,000, you could end up paying between $3,000 and $9,000 in closing costs.

By knowing what to expect and being prepared, you can avoid any nasty surprises and budget accordingly. So if you’re planning to sell your home, be sure to factor in these additional costs to ensure a smooth and stress-free transaction.

Common Closing Costs for Home Sellers- Breakdown of All Fees & Expenses

Selling your home can be an exciting experience, but it’s important to keep in mind that it comes with a fair share of expenses. These costs, commonly known as closing costs, can sneak up on you and leave a dent in your profit.

To help you prepare for the process, we’ve put together a comprehensive breakdown of the typical closing costs for home sellers. This includes all the necessary fees associated with the listing agreement, transfer taxes, and more. By understanding these costs, you’ll be able to plan ahead and avoid any surprises down the road.

At the end of the day, selling your home is a big financial decision, and it’s important to be informed every step of the way. So, take a deep breath, grab a cup of coffee, and let’s dive into the world of closing costs.

1. Listing Agreement:

When you’re in the market to sell your beloved abode, it’s customary to enlist the help of a real estate agent. The two of you will work together to create a listing agreement, which spells out the details of your partnership, including the agent’s commission fee. Usually calculated as a percentage of the sale price, the seller’s agent and the buyer’s agent then divvy it up. The exact amount of the commission can vary based on a number of factors, such as the location of the property and the scope of services provided by the agent.

2. Title and Escrow Fees:

When you’re in the midst of a real estate transaction, you’re likely to come across a few unfamiliar terms. One such term is “title and escrow fees.” These fees are essential for ensuring a smooth and successful transaction, but what do they actually cover?

Title fees are charged by the title company, and they cover the cost of researching the property’s title. This research is necessary to make sure there are no liens or other issues that could derail the sale. Essentially, it’s a thorough investigation of the property’s ownership history to ensure that the seller has the legal right to sell the property and that there are no outstanding claims against it.

Escrow fees, on the other hand, are charged by the escrow company. These fees cover the cost of holding the funds and documents during the transaction process. Essentially, escrow is a neutral third party that holds the money and documents until all the sale’s terms have been met. This protects both parties and ensures a fair and equitable transaction.

So, while title and escrow fees may seem like just another added cost, they’re actually an important part of the real estate transaction process. By paying these fees, you’re ensuring that the sale goes smoothly and that everyone involved is protected.

3. Transfer Taxes:

When you’re buying or selling a property, it’s important to keep in mind that there may be transfer taxes involved. These are fees charged by the local government for the transfer of ownership of the property from one party to another.

The specific amount of transfer tax charged to you can vary depending on your location. It is typically calculated as a percentage of the home’s final sale price.

It’s always a good idea to do your research ahead of time. This may help you budget accordingly for any potential transfer taxes that may come up during the transaction process.

4. Home Warranty:

If you’re planning to sell your home, you might be thinking about ways to sweeten the deal for potential buyers. One option that many sellers consider is offering a home warranty as an added incentive.

This warranty provides coverage for specific items in the home, like your trusty appliances or your HVAC system. And let’s face it, these are the things that keep your home running like a well-oiled machine.

The cost of the home warranty can vary depending on the level of coverage you choose and the company you work with. But in the long run, it could end up saving you and the buyer a lot of hassle and money down the road.

5. Closing Agent Fees:

When it comes to buying or selling real estate, there are many factors to consider, including the services provided by the closing agent. The settlement agent, also known as the skilled professional, plays a crucial role in completing the transaction smoothly and efficiently.

The closing agent is responsible for a wide range of tasks. He is respoansible for the preparation and review of important documents, the distribution of funds, and the recording of the transaction with the appropriate government authorities. As you can imagine, these tasks require a great deal of expertise and attention to detail.

Of course, the cost of these services can vary depending on a number of factors. These factors include the property’s location and the specific services required. However, it’s important to remember that the fees charged by the closing agent are an important investment in the success of your real estate transaction.

How to Estimate Your Closing Costs

Before listing your home for sale, it’s important to have a good idea of what your closing costs will be. Here are some steps to help you estimate your closing costs:

1. Use a Closing Cost Calculator

One of the easiest ways to estimate your closing costs is to use a closing cost calculator. These calculators take into account the sale price of your home, your location, and other factors to provide an estimate of your closing costs.

2. Review Your Loan Estimate

If you have a mortgage on your home, you will receive a loan estimate when you apply for the loan. This estimate will include an itemized list of your closing costs. While this estimate may not be exact, it can give you a good idea of what to expect.

3. Consult with Your Real Estate Agent

Your real estate agent can also provide you with an estimate of your closing costs. They have experience with the local market and can provide insight into typical closing costs in your area.

The Benefits of Knowing Your Closing Costs Beforehand & Tips to Negotiate Them

It’s always a good idea to know what you’re getting into when it comes to closing costs. They can add up quickly and catch you off guard if you’re not prepared. That’s where an estimated closing cost calculator can come in handy. It gives you an idea of what to expect and helps you avoid any unpleasant surprises. Plus, knowing your closing costs ahead of time can give you the knowledge. It’ll help you to make informed decisions about negotiating fees. So, don’t be caught off guard – do your research and be financially prepared for your next transaction. Below is the description of how much are closing costs for a seller and how to negotiate it.

Tips to Negotiate Closing Costs

While closing costs are a necessary expense, there are ways to reduce them. Here are some tips to negotiate closing costs:

- Shop around: One of the best ways to reduce real estate transaction fees is to shop around for the best deal. This includes comparing fees from different lenders, title companies, and attorneys.

- Ask for a breakdown of the fees: When negotiating closing costs, it’s important to understand what you’re paying for. Ask for a breakdown of the fees and question any that seem excessive.

- Negotiate the fees: Some fees may be negotiable. For example, you may be able to negotiate the origination fee or the application fee. Be prepared to make a counteroffer if the fees seem too high.

- Consider the timing: The timing of the closing can also impact the fees. For example, if you close at the end of the month, you may be able to avoid some fees.

- Use a real estate agent: A real estate agent can help you navigate the closing process and negotiate the fees on your behalf.

Understanding the Good Faith Estimate (GFE)

The Good Faith Estimate (GFE) is a document that outlines the estimated closing costs for the buyer. This document is typically provided by the lender within three days of the buyer’s loan application. While the GFE is not a final estimate, it can give sellers an idea of what to expect in terms of closing costs.

It’s important for sellers to review the GFE to ensure that all of the fees are accurate and to identify any potential errors. If there are any discrepancies, sellers should work with their real estate agent and/or their lawyer to address them.

How to Read and Interpret a Good Faith Estimate?

1. Understand the loan terms and interest rates.

One of the most important aspects of the Good Faith Estimate is understanding the loan terms and interest rates. This section will outline the type of loan you are receiving, the interest rate, and any points or fees associated with the loan. It is important to pay attention to the interest rate, as this will determine how much you will pay over the life of the loan. Additionally, be sure to ask about any fees or points associated with the loan, as these can add up quickly and significantly impact the overall cost of your mortgage.

2. Look for additional fees and charges.

When reviewing your Good Faith Estimate, it’s important to pay close attention to any additional fees and charges that may be included. These can include things like appraisal fees, title fees, and origination fees. Make sure to ask your lender about any fees that you don’t understand or that seem excessive. It’s also a good idea to compare the fees listed on your Good Faith Estimate with those from other lenders to ensure that you are getting the best deal possible.

3. Compare estimates from different lenders.

One of the most important steps in the home buying process is comparing estimates from different lenders. This will help you determine which lender is offering the best deal and can potentially save you thousands of dollars in the long run. When comparing estimates, make sure to look at the interest rate, closing costs, and any additional fees or charges. Don’t be afraid to ask questions or negotiate with lenders to get the best deal possible. Remember, this is a big investment and it’s important to do your research and make informed decisions.

4. Ask questions and clarify any confusion.

When reviewing your Good Faith Estimate, don’t hesitate to ask your lender any questions you may have. It’s important to fully understand the terms and fees associated with your loan. If there is anything that is unclear or confusing, ask for clarification. This will help you make informed decisions and avoid any surprises down the road. Remember, your lender is there to help you through the process and should be willing to answer any questions you may have.

Hidden Fees to Watch Out For

While there are many typical closing costs that sellers can expect to pay, there are also some hidden fees that can catch sellers off guard. Here are some hidden fees to watch out for:

1. Attorney Fees

In some states, it’s common for sellers to hire an attorney to assist with the home sale. This can be an additional expense that sellers may not have considered.

2. Homeowners Association (HOA) Fees

If the property being sold is part of a homeowners association, there may be HOA fees that need to be paid at closing. These fees can vary depending on the association and can add up quickly.

3. Courier Fees

Courier fees are another hidden cost that sellers may not have considered. These fees can include the cost of sending documents overnight or via a courier service.

The Difference Between Closing Costs and Pre-Paid Expenses

Closing costs are not the same as pre-paid expenses. Pre-paid expenses are costs that are paid in advance and typically cover things like property taxes, homeowners insurance, and mortgage interest. These expenses are typically paid at closing and can add up quickly.

While pre-paid expenses are not technically closing costs, they are still an important expense to consider when selling your home. It’s important to work with your real estate agent and/or your lawyer to ensure that these expenses are accurately estimated and accounted for.

Closing Costs in a Seller’s Market vs. a Buyer’s Market

Closing costs can vary depending on whether you’re selling your home in a seller’s market or a buyer’s market. In a seller’s market, where there are more buyers than sellers, sellers may be able to negotiate lower closing costs since buyers are more motivated to purchase a home. In a buyer’s market, where there are more sellers than buyers, sellers may need to pay more in closing costs to entice buyers to purchase their home.

Do All States Have the Same Regulations on Seller Closing Costs?

When selling a home, there’s a lot to consider, including the dreaded closing costs. These costs can include fees for appraisals, title searches, surveys, and more. But here’s the thing: each state has its own set of regulations and requirements when it comes to closing costs. So, it’s not a one-size-fits-all situation.

One major factor to keep in mind is the real estate transfer tax rates. The seller typically pays these taxes and they can vary significantly from state to state. For instance, in California, the transfer tax rate is typically around $1.10 per $1,000 of the sales price. However, in New York, the transfer tax rate can be as high as 2.8% of the sales price. It’s important to note these rates. These rates can impact the total amount of closing costs that you’ll be responsible for paying.

Another thing to consider is a state-by-state comparison of closing costs. While the actual costs can vary depending on the specific transaction, there are some general trends to keep in mind. According to a recent report by Bankrate, the average closing costs for a $200,000 home in 2022 ranged from around $3,700 in Missouri to nearly $6,000 in Hawaii. It’s important to factor these costs into your budget and negotiate with the buyer accordingly.

Now, here’s where it gets tricky. Some states have specific regulations when it comes to seller closing costs. For instance, in certain states, it’s illegal for the seller to pay for certain closing costs, such as the buyer’s appraisal or inspection fees. Other states have limits on how much the seller can contribute towards the buyer’s closing costs. It can be a lot to navigate. But that’s why it’s crucial to have a knowledgeable real estate agent or attorney on your side.

In conclusion, closing costs are a necessary evil when it comes to selling a home. Just remember to do your research, factor in state-specific regulations and taxes. Work with a trusted professional to ensure everything goes smoothly.

Conclusion: Preparing Yourself with Knowledge of Closing Fees Can Help You Maximize Your Profits as a Home Seller

Selling your home can be a daunting task, and navigating the world of real estate can be overwhelming. Closing costs are one of the many expenses that you’ll need to be aware of. They can significantly impact your profits. Understanding these costs and the options available to you can help you make informed decisions and achieve the best possible outcome.

By partnering with Elite Properties, a reputable real estate agency, you can rest assured that you’ll have a team of experienced professionals on your side. They’ll guide you through every step of the home-selling process, from preparing your home for sale to negotiating with potential buyers. With their help, you’ll be well-equipped to handle closing costs and other expenses.

Don’t let closing costs catch you off guard. Contact Elite Properties today to learn more about how they can help you maximize your profits as a home seller. With their support and expertise, you can sell your home with confidence and achieve your desired results.